Q4 outdoor industry web traffic & trends

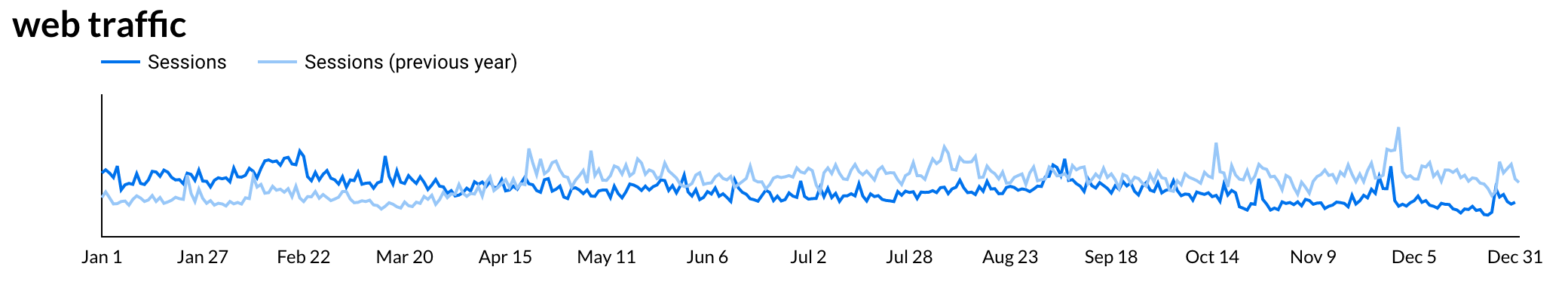

The same trends have dominated 2021, and Q4 was no exception - in fact, these trends were more apparent than ever through the holiday shopping season. Long story short, web traffic continues to be down year over year, with conversion rates flat or even up. That said, industry web traffic is still trending at a steady rate to the more normal baseline year of 2019. Keep reading for more breakdowns of the numbers and some interesting areas that we’re watching going into 2022.

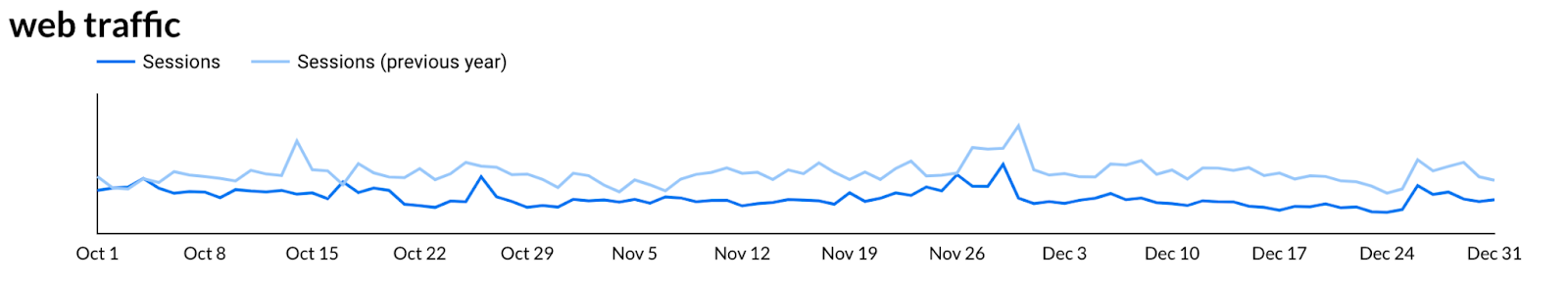

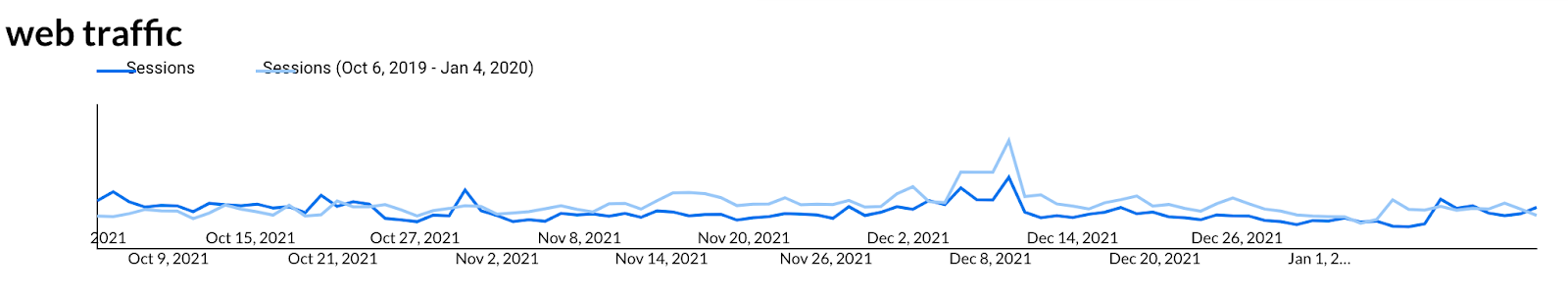

At this point, we probably don’t even need to name the trends, but here they are again - inventory issues, supply chain & logistics challenges, and large comps from the COVID boom. Rather than make up for these challenges, the holiday season exacerbated them, leading to customer-facing challenges like lack of product availability, few discounts, and shipping uncertainties. Despite all of these headwinds, traffic comps still remained consistent to 2019. By the numbers, outdoor industry web traffic finished off 2021 with some of the largest year-over-year misses of the year. Total web traffic was down -40% YOY, but only down -15% to 2019.

Traffic - Calendar Year Total

Q4 Web Traffic - Year Over Year

Q4 Web Traffic - To 2019

trends we’re looking at going into 2022

Gift Cards

With inventory and shipping being major headaches in the 2021 holiday season, gift cards saw explosive growth with sales up 114% year over year. Looking at your own gift card sales and creating strategies to engage these people is an interesting and fun challenge.

Supply Chain Recovery

Towards the end of the year, we saw some small improvements in our disrupted supply chains, and 2022 does appear to still have recovery on the horizon. However, experts in the industry are still forecasting turmoil to continue. Continuing to stay nimble here is important - tuning strategies and channels to inventory levels.

Discounting

High demand has led many brands and retailers to pull back on discounting. Coupled with low inventory levels, the need to drive volume has lessened. Adobe estimated that average discounts were only 8%, compared to 21% in 2021 this holiday season. As demand for products cools from COVID-fueled highs and consumers continue to shift dollars back into services and experiences brands will need to reconsider their limited discounting strategies.

Traffic Trends

Given the current traffic trends, we expect misses to continue through Q1 of 2022, with an interesting possible inflection point coming around April. April 2021 is where we began to see traffic missing year over year as the pandemic boom began to wane. The relatively small misses to 2019 mean that at this point traffic trends could be much closer to even or positive year over year from 2022 to 2021 - somewhat of a return to “normal” comps. We’ll be watching this intently.

takeaways

The past two years have taught us that uncertainty is certain, and we’ve learned so much about being adaptable both in our businesses and our lives as consumers. Going forwards, this means focusing on individual channel performance, measuring, and reacting. In our Black Friday & Cyber Monday Traffic Report, we shared some tips and tactics for each web channel. This said, we will be paying close attention to some big traffic trends that we talked about here, and how we continue to redefine normal.